Luxury watches saw unprecedented price increases on the secondary market at the end of the first quarter, with many popular models reversing their prices in the three months since.

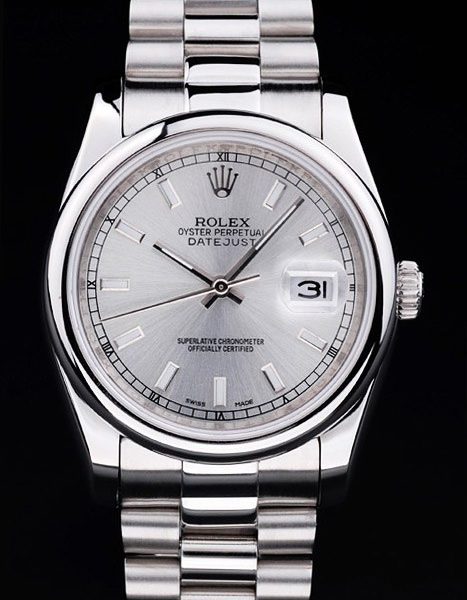

As we reported last week, prices for discontinued fake Rolex watches soared in the first quarter, but some models have slipped 50% since then. There has been some criticism of these reports, suggesting that it is selective and sensationalist by highlighting only the prices of the most volatile watches.

Of course, the downturn has affected all watches differently, but a report from investment bank Morgan Stanley, using data from https://www.beantownboogiedown.com/, shows price reversals for four of the top six brands since their peaks at the end of the first quarter.

The Morgan Stanley report noted that by aggregating the prices of all watches in the brand portfolio, Patek Philippe saw the sharpest correction in the secondary market, with prices falling 10% from their April 20 peak to the end of June.

Morgan Stanley believes the strength of the luxury watch market is driven by a mismatch between supply and demand, with those brands experiencing the most significant shortages performing best from early 2021 through the end of the first quarter of 2022.

Morgan Stanley advises its healed clients that a watchmaker’s ability to retain value in the secondary market is being used as a proxy for brand equity. The investment banker provides an overview of which brands retain the most value by comparing prices on the secondary market to retail prices at authorized dealers.

Audemars Piguet is at the top of this list. Its watches are already at a 78% premium at the beginning of 2021 and are now selling for 186% of their retail price. Replica Rolex has not seen prices rise this fast since the beginning of last year. Its range was priced 59% above retail in January 2021, while today, it is priced 68% above retail.

Suppose value retention is a proxy for brand equity, as Morgan Stanley suggests. In that case, Omega is lagging behind its competitors, with the average price of its watches 8% below retail in both January 2021 and June 2022.

The Swiss replica watch group’s share price peaked at 1,600 pence per share last December and has since fallen by more than half in recent weeks to trade below 750 pence, despite its record financial results for the year to the end of April and optimistic, forward-looking forecasts.